Gold

Best Sellers

The Importance of Gold Bullion in Your Portfolio

- Quality Gold bullion maintains its value over time, acting as a hedge against inflation and currency devaluation.

- Adding gold reduces overall portfolio risk due to its low correlation with stocks and bonds.

- During economic uncertainty or geopolitical tension, gold retains or increases in value as investors seek stability.

- Gold bullion is globally recognized and can be easily bought or sold in most markets.

- Unlike digital or paper investments, gold is a physical asset, providing security against cyber threats or institutional failure.

- Gold’s scarcity contributes to its value, making it a reliable long-term store of wealth.

- Physical gold does not rely on a third party to fulfill a contract, reducing exposure to default risk.

- Gold is accepted and valued worldwide, making it a universally trusted asset in any economic climate.

Shop All Gold Products

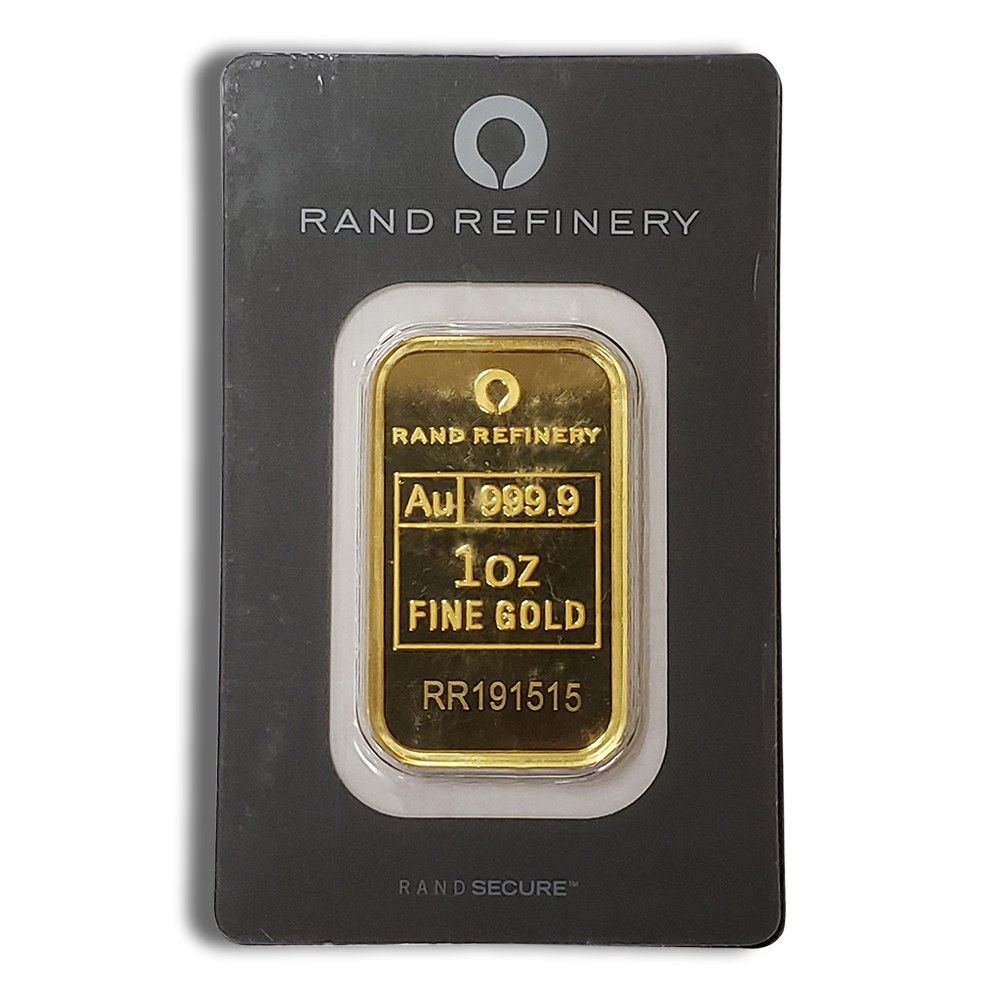

Gold Bars

From 1 oz to 100 oz we have a wide range of gold bars

Gold Rounds

Elegent Gold Rounds at or near spot price.

Gold Coins

A Wide Selection of Gold Coins of all denominations

Featured Gold Products

Our Best Sellers and Hand Selected Gold Products

Gold – A timeless treasure

The value of our Quality Gold Bullion and other products in your portfolio can serve as a hedge against inflation and economic uncertainty. Gold has historically retained its value over time and can act as a safe haven asset during periods of market volatility. Additionally, owning gold can provide diversification to your investment portfolio, reducing overall risk. As a tangible asset, gold can also provide a sense of security and stability in times of economic turmoil. Overall, including gold in your portfolio can help protect and preserve your wealth over the long term.

Source: tradingviews.com

The History of Gold in Portfolios

Gold has played a significant role in investment portfolios for centuries, serving as both a store of value and a hedge against economic uncertainty. Its use dates back to ancient civilizations, but its formal inclusion in investment strategies became more pronounced in the modern financial era.

Gold has been valued since ancient times for its rarity, durability, and beauty. It was used as money, in jewelry, and for ceremonial purposes. While not part of structured investment portfolios, it served as a primary medium of exchange and a store of wealth, laying the groundwork for its future investment role.