Silver

Best Selling Silver Products

Importance of adding silver bullion to your portfolio

- Adding silver can reduce overall portfolio risk by diversifying across asset classes.

- Silver historically retains value and can protect purchasing power during periods of high inflation.

- Silver bullion is widely recognized and easily bought or sold in global markets.

- Silver is a physical asset, offering security outside of the digital or paper financial system.

- Silver is used extensively in electronics, solar panels, and medical applications, supporting long-term demand.

- Compared to gold, silver is more affordable, making it accessible to a broader range of investors.

- In times of economic or geopolitical uncertainty, silver often performs well as a safe-haven asset.

- Supply constraints and increasing demand may lead to long-term price growth.

- Unlike stocks or bonds, owning physical silver means you are not relying on an issuer or intermediary.

- Silver has been used as money and a store of value for thousands of years across civilizations.

Shop All Silver Products

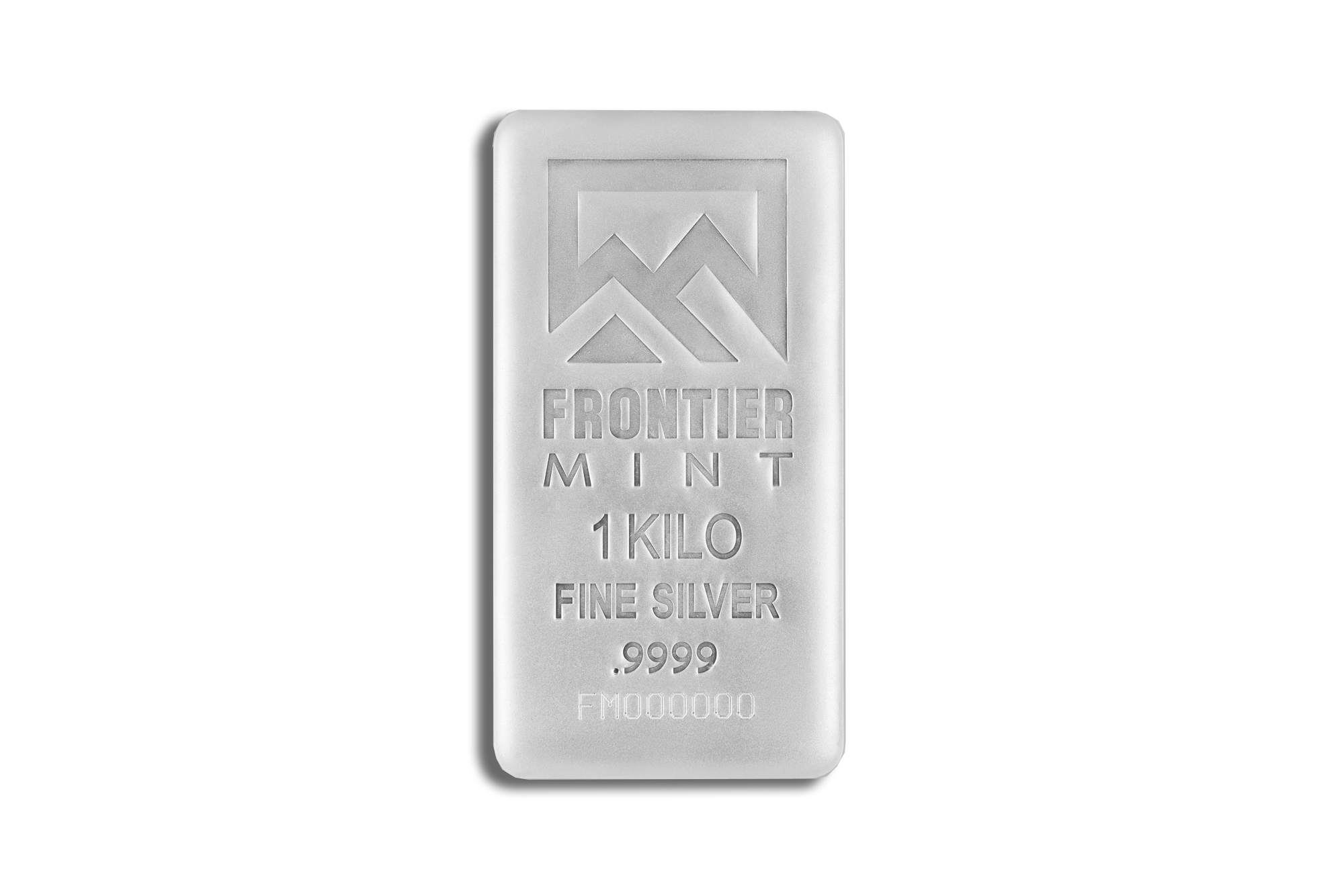

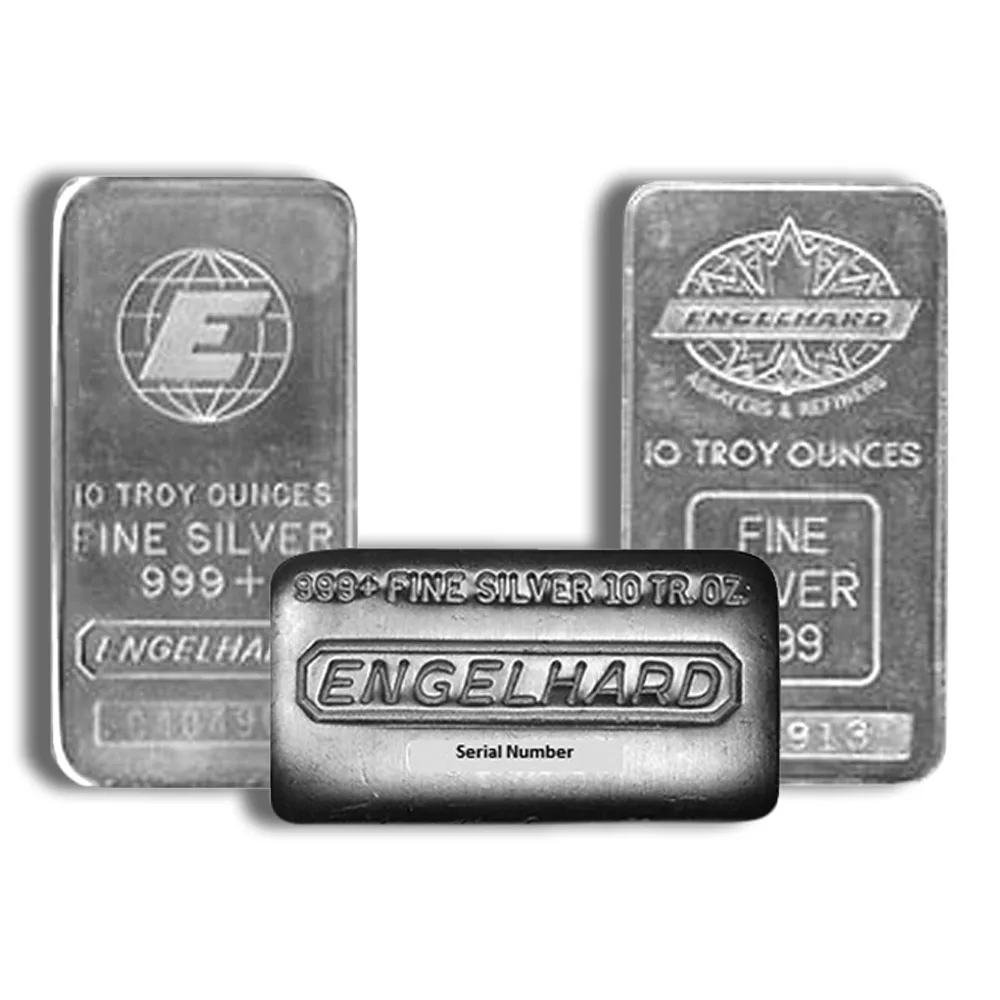

Silver Bars

Browse our Silver Bars

Silver Rounds

Silver Rounds

Silver Coins

Our Assortment of Silver Coins

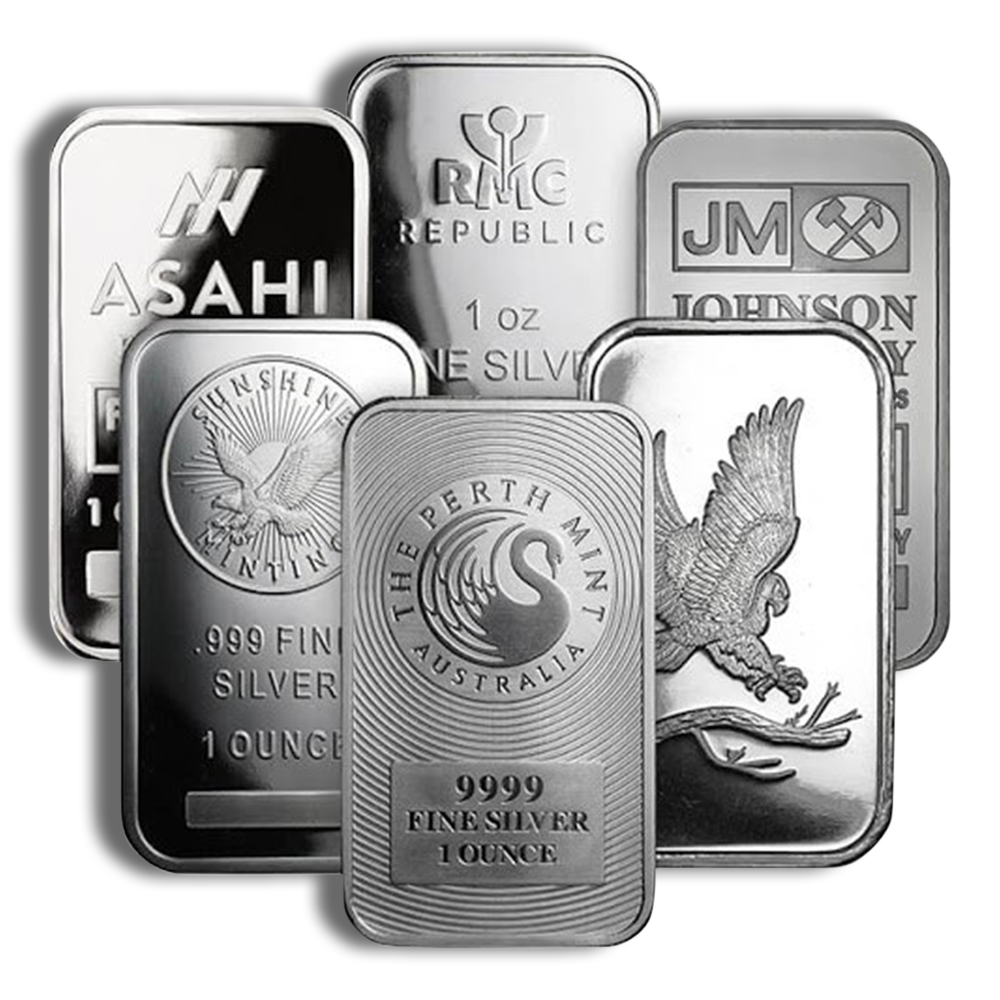

Featured Products

Our Featured Silver Products

Silver – safety in your portfolio

When considering the value of adding Silver to your portfolio, it is important to understand the unique benefits that this precious metal can provide. Silver has long been considered a safe haven asset, offering investors a hedge against inflation and economic uncertainty.

Investors have long considered silver a safe haven asset, offering a hedge against inflation and economic uncertainty.

Its intrinsic value and limited supply make it a reliable store of wealth, particularly during times of market volatility.

In addition to its role as a store of value, Silver also has industrial applications, making it a versatile and in-demand commodity. As the global economy continues to grow and evolve, various industries such as electronics, medical devices, and solar panels are expected to increase their demand for silver, which may drive up its price and potentially increase the value of your portfolio.

Overall, adding Silver to your portfolio can help to enhance its overall stability and potential for long-term growth. By including this precious metal in your investment strategy, you can benefit from its unique properties and potential for capital appreciation, while also protecting your wealth against economic uncertainty and market fluctuations.